A suite of essential tools to manage regulatory requirements, compliance due diligence and mitigate the risk of money laundering and financial fraud.

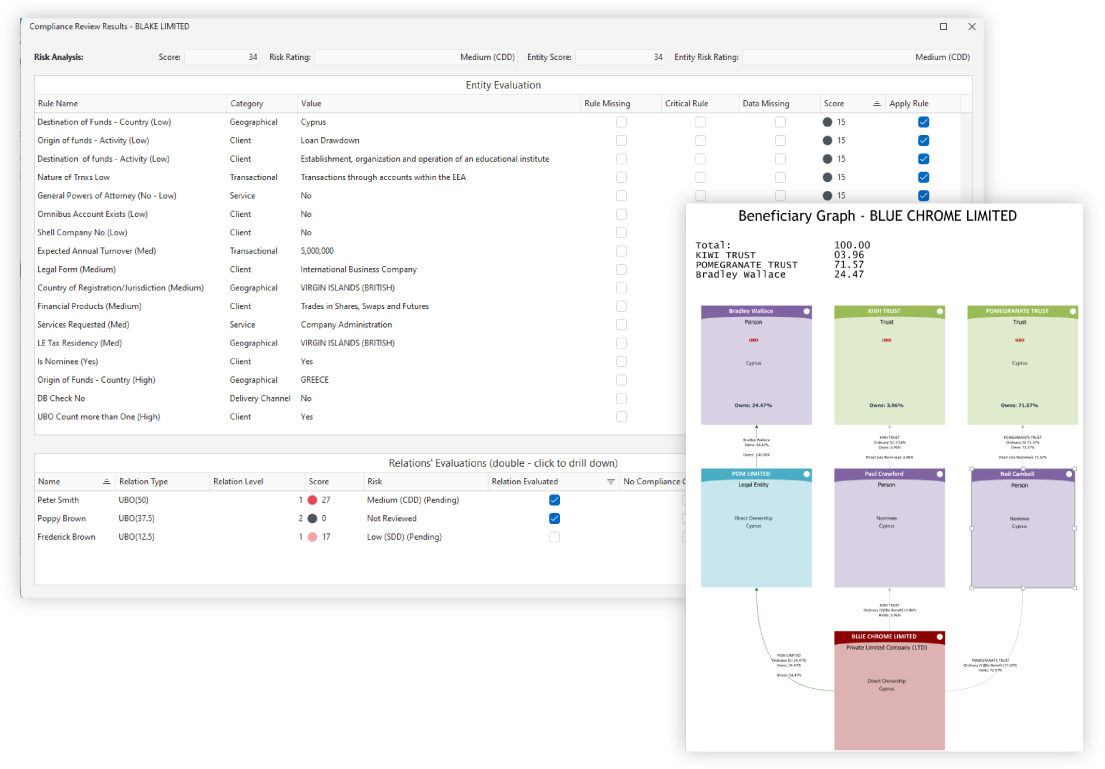

Perform assessments on all your entities, individuals and companies, and automatically create dates for due diligence follow up. Customizable risk scoring allows you to tailor risk assessment models to your specific needs while meeting regulatory requirements.

Save time onboarding clients by using integrated tools for background checks (MemberCheck and Lexis Nexis) and identity document verification (Shufti Pro). Ongoing monitoring ensures you keep ahead of any changes.

Customer risk profiling evaluates risk factors based on KYC data captured in the Economic Profile during onboarding. Analysis of this data produces a wealth of useful reports including statistics for regulatory reporting and a UBO register with all changes tracked.

Compare Economic Profile data to Banking data to identify out-of-scope activities, to flag potential suspicious activity and receive warnings when customers exceed or are nearing transaction limits.